Hey there! If you’re considering getting an FHA loan, you might have heard about Rocket Mortgage as an option. But is Rocket Mortgage a good choice for FHA loans? Let’s dive in and explore the pros and cons of using Rocket Mortgage for your FHA loan needs.

Pros and Cons of Using Rocket Mortgage for FHA Loans

When it comes to obtaining an FHA loan, many borrowers may wonder if using Rocket Mortgage is a good option. Rocket Mortgage, known for its fast and convenient online mortgage application process, can be a great choice for those seeking an FHA loan. However, like any financial decision, there are both pros and cons to consider before moving forward with Rocket Mortgage for an FHA loan.

One of the main advantages of using Rocket Mortgage for an FHA loan is the convenience it offers. With Rocket Mortgage’s online platform, borrowers can easily submit all necessary documentation and go through the entire mortgage application process without ever leaving the comfort of their home. This can save time and hassle compared to traditional mortgage lenders who require multiple in-person meetings and paper documents.

Additionally, Rocket Mortgage is known for its fast approval process. Borrowers can receive pre-approval for an FHA loan in as little as a few minutes with Rocket Mortgage, allowing them to start house hunting sooner rather than later. This expedited process can be especially beneficial for those in competitive housing markets where speed is key.

Another benefit of using Rocket Mortgage for an FHA loan is the transparency it provides. With Rocket Mortgage, borrowers can easily see and compare different loan options, interest rates, and fees in one place. This level of transparency can help borrowers make more informed decisions about their FHA loan and potentially save them money in the long run.

On the other hand, there are some potential drawbacks to using Rocket Mortgage for an FHA loan. One concern is the lack of personalized customer service compared to traditional mortgage lenders. While Rocket Mortgage offers support through phone, email, and chat, some borrowers may prefer the face-to-face interactions and personalized guidance that a local lender can provide.

Another consideration is the potential for higher fees with Rocket Mortgage. While Rocket Mortgage advertises competitive rates, some borrowers have reported paying higher closing costs and fees compared to working with a traditional lender. It’s important for borrowers to carefully review all costs associated with a Rocket Mortgage FHA loan to ensure they are getting the best deal.

In conclusion, using Rocket Mortgage for an FHA loan can be a convenient and efficient option for many borrowers. The online platform, fast approval process, and transparent loan options make Rocket Mortgage an attractive choice. However, it’s important to weigh the potential drawbacks, such as limited customer service and higher fees, before deciding if Rocket Mortgage is the right fit for your FHA loan needs.

How Rocket Mortgage Streamlines the FHA Loan Application Process

When it comes to applying for an FHA loan, Rocket Mortgage offers a streamlined process that makes it quick and easy for borrowers to get approved. One of the key ways that Rocket Mortgage simplifies the FHA loan application process is by providing an online platform that allows borrowers to complete the entire application from the comfort of their own home.

With Rocket Mortgage, borrowers can easily access the FHA loan application form online and fill it out at their own pace. This eliminates the need for multiple trips to a physical bank or lender and saves borrowers valuable time. The online platform also allows borrowers to upload all necessary documents, such as pay stubs and bank statements, directly to their application, further streamlining the process.

Another way that Rocket Mortgage streamlines the FHA loan application process is by providing personalized loan recommendations based on the borrower’s financial situation. By inputting key financial information into the online platform, borrowers can quickly see what type of FHA loan they qualify for and what their monthly payments would be. This level of transparency helps borrowers make informed decisions and speeds up the application process.

Additionally, Rocket Mortgage has a team of dedicated loan experts who are available to assist borrowers throughout the application process. Whether borrowers have questions about the application form or need help uploading documents, the loan experts at Rocket Mortgage are there to provide guidance and support every step of the way.

Overall, Rocket Mortgage offers a user-friendly and efficient way for borrowers to apply for an FHA loan. By providing an online platform, personalized loan recommendations, and access to loan experts, Rocket Mortgage streamlines the FHA loan application process and helps borrowers get approved quickly and easily.

Comparing Rocket Mortgage to Traditional FHA Lenders

When it comes to finding the right lender for your FHA loan, it’s important to weigh your options and compare what different lenders have to offer. Rocket Mortgage, an online mortgage company, has become increasingly popular for its convenience and efficiency. However, traditional FHA lenders, such as banks and credit unions, also have their own advantages to consider.

One of the main advantages of Rocket Mortgage is its online platform, which allows borrowers to complete the entire mortgage application process from the comfort of their own home. This can be a huge time-saver for busy individuals or those who prefer the convenience of not having to visit a physical lender. Additionally, Rocket Mortgage has a user-friendly interface that guides borrowers through each step of the application, making it easy for even first-time homebuyers to navigate.

On the other hand, traditional FHA lenders may offer a more personalized experience for borrowers who prefer to work directly with a loan officer. These lenders often have local branches where borrowers can meet face-to-face with their loan officer to discuss their options, ask questions, and receive guidance throughout the application process. This personalized touch can be reassuring for borrowers who value human interaction and a more hands-on approach to their mortgage application.

In terms of interest rates and fees, Rocket Mortgage and traditional FHA lenders may vary. It’s important for borrowers to compare rates and fees from multiple lenders to ensure they are getting the best deal possible. Rocket Mortgage may offer competitive rates and fees due to its streamlined online process, but traditional lenders may also have incentives or promotions that could make them a more cost-effective option.

Ultimately, the decision between Rocket Mortgage and traditional FHA lenders will depend on your individual preferences and priorities. If you value convenience, efficiency, and a user-friendly online platform, Rocket Mortgage may be the right choice for you. However, if you prefer a more personalized experience and the ability to meet face-to-face with a loan officer, a traditional FHA lender may be a better fit.

Regardless of which lender you choose, it’s important to do your research, compare your options, and carefully review all terms and conditions before committing to a mortgage loan. By taking the time to explore different lenders and understand what they have to offer, you can make an informed decision that best suits your needs and financial goals.

Understanding the Fees and Requirements of FHA Loans through Rocket Mortgage

When considering an FHA loan through Rocket Mortgage, it is essential to understand the fees and requirements associated with this type of loan. FHA loans are government-backed loans that are popular among first-time homebuyers due to their low down payment requirements and flexible credit score guidelines.

One of the key benefits of obtaining an FHA loan through Rocket Mortgage is the low down payment requirement. With an FHA loan, borrowers can qualify for a down payment as low as 3.5% of the purchase price of the home. This is significantly lower than the typical 20% down payment required for conventional loans, making homeownership more attainable for many individuals.

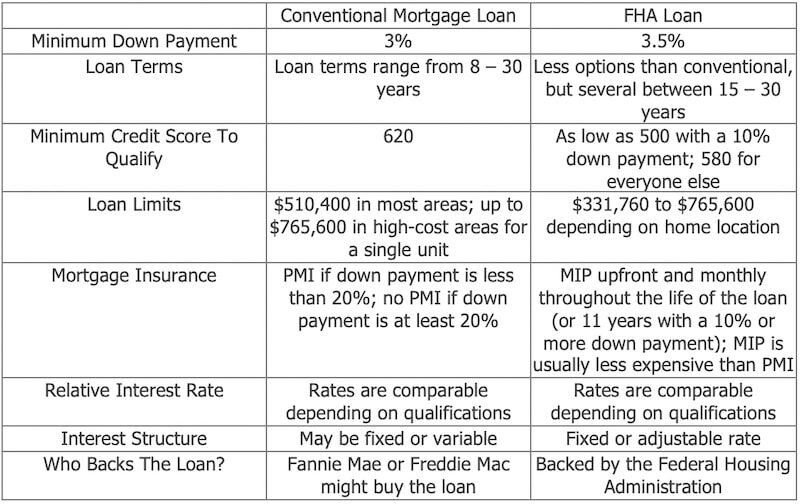

In addition to the low down payment requirement, FHA loans through Rocket Mortgage also have flexible credit score guidelines. While conventional loans often require a minimum credit score of 620, FHA loans are more lenient and may be accessible to borrowers with lower credit scores. This can be particularly beneficial for individuals who may have experienced financial setbacks in the past and are working to rebuild their credit.

When obtaining an FHA loan through Rocket Mortgage, borrowers should be aware of the fees associated with this type of loan. Like all mortgages, FHA loans come with closing costs, which can include fees for services such as appraisals, title searches, and loan origination. These costs can add up, so it is essential for borrowers to budget accordingly and understand the full scope of expenses associated with obtaining an FHA loan.

Another important aspect to consider when obtaining an FHA loan through Rocket Mortgage is the mortgage insurance premium (MIP). Unlike conventional loans, FHA loans require an upfront MIP payment as well as an annual MIP payment. The MIP serves as insurance for the lender in case the borrower defaults on the loan, and it is typically included in the monthly mortgage payment. Borrowers should factor in the cost of MIP when calculating the overall affordability of an FHA loan.

In conclusion, obtaining an FHA loan through Rocket Mortgage can be a good option for individuals who may not qualify for a conventional loan due to limited funds for a down payment or lower credit scores. By understanding the fees and requirements associated with FHA loans, borrowers can make informed decisions and work towards achieving their dream of homeownership.

Reviews and Feedback on Using Rocket Mortgage for FHA Loans

When it comes to using Rocket Mortgage for FHA loans, many customers have had positive experiences. The convenience of being able to complete the entire application process online, including submitting necessary documents and receiving approval, has been a major selling point for users.

One common praise for Rocket Mortgage is their user-friendly interface. Customers have mentioned how easy it is to navigate the website and fill out the required information. This has saved them time and frustration compared to traditional lenders who require in-person meetings and paper forms.

Additionally, customers have appreciated the transparency of Rocket Mortgage in terms of fees and rates. Many reviews mentioned that the rates offered by Rocket Mortgage for FHA loans were competitive and in line with industry standards. This has given customers peace of mind knowing they are getting a fair deal.

Another aspect that customers have highlighted in their reviews is the speed of the approval process. Many users have mentioned that they were able to get approved for their FHA loan in just a matter of days, as opposed to weeks or even months with other lenders. This has been a major selling point for busy individuals who need to secure financing quickly.

Lastly, many customers have noted the excellent customer service provided by Rocket Mortgage. Whether they had questions about the application process or needed assistance with their loan, customers have mentioned that the Rocket Mortgage team was responsive and helpful. This level of support has made the entire loan process smoother and less stressful for users.

Originally posted 2025-02-02 15:00:00.